If you have followed my annual predictions over the years, you know they have been remarkably accurate. My thoughts on 2025 were possibly the most accurate yet. AI didn’t just go mainstream, it impacted every industry. Today, every CEO has an AI strategy and implementation plan. The payoff? Massive productivity gains and, as predicted, a surge in the stock market. And after a long drought, M&A, IPOs, and VC investments increased in the second half of the year.

As 2025 comes to a close, it’s time to look ahead and prepare for what 2026 will bring. Last year, many of my predictions revolved around AI. This year, my mentality is “fasten your seatbelt.” 2026 will be all about AI and I’m more bullish than ever on the outcomes. AI will power U.S. economic resilience, accelerate startup growth, transform entire industries, and redefine global tech leadership. But it’s not all upsides. The market’s heavy AI concentration creates risk, and I remain concerned that we are not prepared for the scale of change ahead.

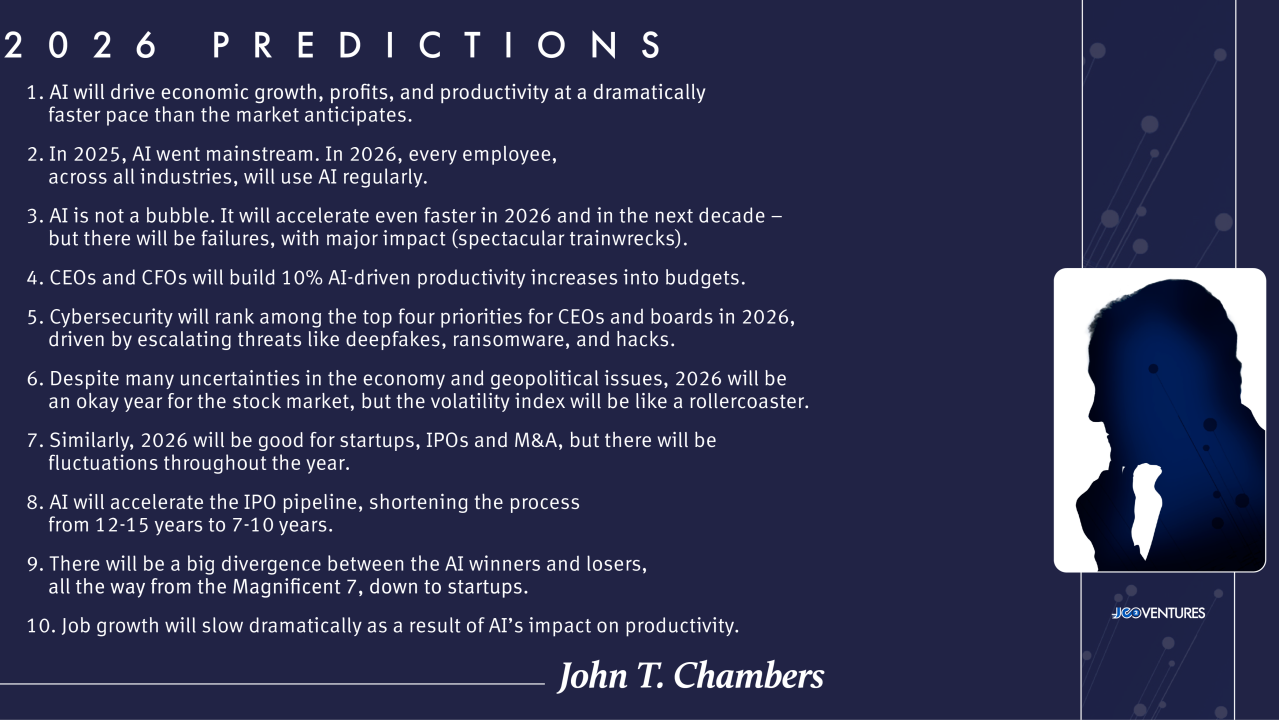

Here are my business, technology and economic predictions for 2026, as I shared with Jennifer Schenker for my column in The Innovator:

1. AI will drive economic growth, profits, and productivity at a dramatically faster pace than the market anticipates. AI-driven enterprise impact started to move the needle in 2025, but 2026 will be the breakout year. Lower inflation and falling interest rates should add fuel, even if the pace is slower than investors hope. My advice: never bet against the U.S. Federal Reserve. If rates fall as projected, markets will rise. The only unknown is by how much.

2. In 2025, AI went mainstream. In 2026, every employee, across all industries, will use AI regularly. AI is unlike any other tech transition we’ve ever seen: faster, more disruptive, more transformative. This isn’t incremental change; it’s a revolution reshaping even the most traditional verticals. For leaders, this is the moment to break away and emerge as a leader that is redefining the industry as a whole. The choice is clear: disrupt or be disrupted; adopt AI or get left behind. And it doesn’t stop at simply adopting AI – it’s the responsibility of your company to train and empower every employee, from entry-level employees to the C-suite, to leverage it. Those who enable their workforce will lead and those who don’t will lose.

3. AI is not a bubble. It will accelerate even faster in 2026 and in the next decade – but there will be failures, with major impact (spectacular trainwrecks). We are just at the start of the AI era and only beginning to see the power and impact of it on our daily lives, in business, and with the market as a whole. And I think this era has the potential to have a century-long run. There is nothing short-term about AI except when it comes to the winners and losers – while it used to take decades for leaders to emerge and laggers to disappear, the cycle is accelerating and companies have only 1-2 years to prove their staying power. The market will have moments of panic, particularly as these spectacular trainwrecks happen, but I know it will recover. AI is here to stay. As Andy Grove used to say, “Only the paranoid survive.” The winners will move with tremendous conviction and speed, dig moats quickly to protect themselves, and constantly redefine how they are differentiating themselves.

4. CEOs and CFOs will build 10% AI-driven productivity increases into budgets. AI-driven productivity gains will explode across traditional enterprises and tech-native AI companies. Well-run companies will achieve or exceed 10% annual productivity growth, and if leaders are not challenging their organization to hit that goal, they’re not doing their job. This push must be CEO-and-CFO-driven and formally built into 2026 budgets. Using AI to boost productivity and create new revenue streams will run in parallel, but in the short-term, productivity will dwarf revenue generation.

5. Cybersecurity will rank among the top four priorities for CEOs and boards in 2026, driven by escalating threats like deepfakes, ransomware, and hacks. Large companies rely on 50-100 siloed cybersecurity providers, making it impossible for leaders to accurately link investment to business outcomes. As cyber threats get more complex, particularly with “bad” AI – deepfakes, ransomware, hacks and more – organizations need consolidation and a platform-based cyber architecture. That’s why I’m backing startups like Safe Security, which is building AI-native platforms to unify cyber risk and exposure management.

6. Despite many uncertainties in the economy and geopolitical issues, 2026 will be an okay year for the stock market, but the volatility index will be like a rollercoaster. The “Magnificent 7” stocks – Apple, Microsoft, Alphabet (Google), Amazon, Meta, Nvidia, and Tesla – currently control over $20 trillion in market cap and represent over a third of the entire S&P 500. They will drive the biggest AI deals and dominate market performance. If they perform well, the market thrives; but if one or more of these companies loses 50-70% of its market cap, it could take down half a dozen big players and countless startups with it, triggering an economic shockwave and massive trainwrecks. The volatility index for the stock market will be a rollercoaster, but I am optimistic that the year will end okay overall. However, I caveat this by recognizing geopolitical and trade tensions could reshape the outlook entirely.

7. Similarly, 2026 will be good for startups, IPOs and M&A, but there will be fluctuations throughout the year. 2025 laid the groundwork for a robust IPO and M&A market, following a multi-year drought. I am betting that in 2026, the number of unicorns and decacorns (startups with a valuation of $10 billion or more) will grow dramatically, which are the startups primed to go public or be acquired. In the JC2 Ventures portfolio, we have 12 unicorns, two of which are decacorns – a strong indicator that our investment strategy is right on track. Additionally, more enterprises – from tech leaders to traditional players – will turn to startups to reach their AI-driven productivity goals, fueling win-win partnerships and also acquisitions at speed. Nvidia and AMD are already doing this at tremendous speed, and others will follow in 2026. But make no mistake: the ride will be bumpy, with extreme ups and downs parallel to market swings.

8. AI will accelerate the IPO pipeline, shortening the process from 12-15 years to 7-10 years. The time it takes for a startup to go from inception to unicorn to IPO has peaked at 12–15 years on average. Now, thanks to AI, companies can develop products 5-10X faster, bring products to market with satisfied reference customers, and cross the chasm to full volume at 3X the outcomes. AI will also streamline the IPO process itself by automating paperwork and quickly analyzing market trends, ultimately freeing leaders to focus on strategy and investor engagement. As a result, expect to see IPO timelines shrink by 3–5 years, which will mean more early-stage IPOs. Success will require predictability, free cash flow, and profits – not just a $1B run rate.

9. There will be a big divergence between the AI winners and losers, all the way from the Magnificent 7, down to startups. The old distribution of the industry bell curve – 15% at the top, 15% at the bottom, and 70% safely in the middle – no longer holds and it will flatten dramatically. In the AI era, the “middle” is no longer a safe place to be. Average performers will struggle to survive, while the winners will pull dramatically ahead. To avoid getting stuck in the middle, companies must move faster and ask: how will we differentiate with AI, and what moats can we build to protect ourselves? A good example of this is Google, which moved aggressively after being overtaken early on by Microsoft and OpenAI, and is now launching AI chips and challenging Nvidia and Microsoft head-on. The lesson is clear: in the age of AI, staying ahead requires embracing change, continuous innovation, and a relentless pursuit of growth at breakneck speed.

10. Job growth will slow dramatically as a result of AI’s impact on productivity. My single biggest concern with AI is job displacement. We’re already seeing the trend: Amazon, Microsoft, Salesforce, and UPS have laid off thousands of employees, and industry leaders like Walmart and Ford have openly said that revenue will rise while headcount falls. I believe AI will create many new jobs over time, but there will be a lag between rapid job destruction and job creation in the early years. Recent high school and college graduates, as well as workers over 50 who can’t or won’t adapt to AI, will be hit the hardest. AI-native startups, unicorns, and decacorns will help with job creation, but education systems and traditional businesses must move faster to retool and retrain the workforce to help absorb the shock.

So, where does this leave us as we plan for 2026? The hard truth is that traditional, average companies are already in trouble. Meanwhile, the winners will be nothing short of spectacular – scaling faster, strategically partnering, and building competitive moats at a pace we’ve never seen before. Startups have a major opportunity to make an impact.

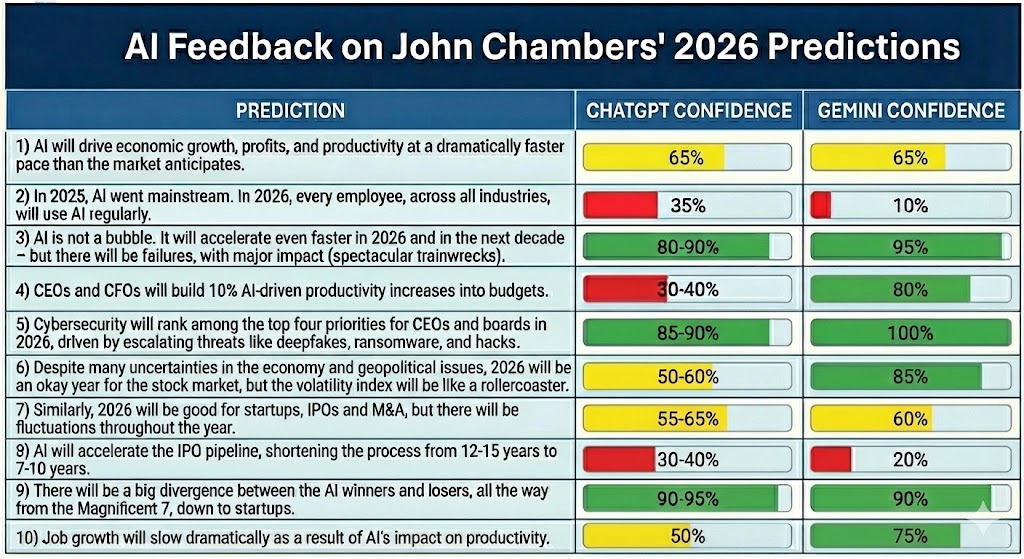

And, if you’re interested – while I didn’t use AI to craft my predictions, I did run my final list through ChatGPT and Gemini for feedback. The graphic below, which I also developed using AI (with Gemini’s Nano Banana tool specifically), outlines AI’s perceived confidence in each prediction. The results fascinated me. I’m already looking forward to seeing how my thoughts compare to AI’s estimated accuracy.